Wednesday, October 31, 2012

Tuesday, October 30, 2012

Monday, October 29, 2012

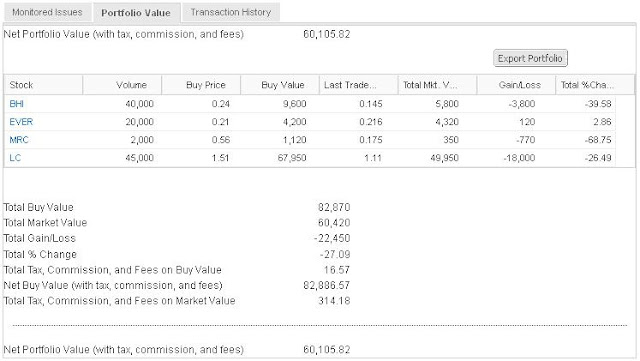

Portfolio Value as of October 29, 2012

It was a very profitable day for our portfolio. EVER took the number 1 spot in the Top Gainers today with 49.06% gains, followed by BHI in the number 2 position with 31.21% increase. MRC is in 18th spot with 4.22% change. LC remains the laggard in our portfolio.

Thursday, October 25, 2012

Wednesday, October 24, 2012

Tuesday, October 23, 2012

Monday, October 22, 2012

Thursday, October 18, 2012

Wednesday, October 17, 2012

Portfolio Value as of October 17, 2012

EVER - took a breather today. From a high of .26, it closed at .248. It must cool down the RSI before continuing the uptrend.

Tuesday, October 16, 2012

Monday, October 15, 2012

Friday, October 12, 2012

Thursday, October 11, 2012

Wednesday, October 10, 2012

Tuesday, October 9, 2012

Monday, October 8, 2012

Friday, October 5, 2012

Lepanto Readying Raps vs. Protesters

La Trinidad, BENGUET – Mining giant Lepanto Consolidated Mining Company is readying suits against protesters who tried to stop the serving last September 17 of a writ of preliminary injunction against them in connection to a gold exploration project in Mankayan town, Benguet.

Knestor Godino, vice president for administration of the LCMC said appropriate charges are being readied against those who unlawfully barred sheriffs from implementing a court order allowing Far Southeast Gold Resources Inc. (FSGRI) to fence off an already private property of the firm meant for drilling in Tabio, Madaymen, Mankayan.

They could not be defying the law, Godino said, citing the September 17 scuffle between 100 protesters against sheriffs and policemen implementing the court order.

Even citing Commission on Human Rights Cordillera reports, Godino criticized protestors for continuing to defy lawful orders, the latest of which was issued by Regional Trial Court branch 64 Presiding Judge Agapito Laoagan to allow LCMC to fence the area for its exploration activities.

Earlier on April 23, this year too, the National Commission on Indigenous People - Cordillera Administrative Region has sided with the LCMC and reversed its earlier temporary restraining order and denied the protesters’ request for the issuance of a writ of preliminary injunction. In that order, the protesters were directed to freely allow FSGRI to resume its drilling operations in Madaymen, upon the posting of a P500,000 bond. “We posted the bond requirement,” Godino said.

Again on on July 24, 2012 the NCIP Sheriff attempted to implement the Orders in NCIP Case 03-CAR-12 dated April 4 and 23, 2012.

"To ensure peaceful implementation of this Order, we sought assistance from elements of the Philippine National Police and also invited members of the Commission on Human Rights to observe that no violations of human rights were committed, either by the company or by members of the PNP," Godino noted.

But picketers openly refused and resisted the direct order of the sheriff, prompting Lepanto to voluntarily suspend the implementation of the order when the protesters reportedly started to become unruly.

Citing lawyer Harold D. Kub-aron, regional director of the Commission on Human Rights – Cordillera, Godino said the protesters openly defied every lawful order.

"There must be a stop into these," said Godino, foisting charges versus protesters.

The Far Southeast Gold Project, a joint venture between LCMC and the South Africa-based Gold Fields Inc., started the drilling in the disputed area in Madaymen late December 2011.

But land claimants (two of the eight families laying claim to the land) with the help of some residents stopped the operations. The protesters eventually built a shack in the area to secure the site and ignored every court order.

The drilling is for exploratory purposes prior to FSGRI's plan to mine an ore body more than a kilometer deep and some areas in Mankayan already agreed for similar activities.

source: http://www.philstar.com

Knestor Godino, vice president for administration of the LCMC said appropriate charges are being readied against those who unlawfully barred sheriffs from implementing a court order allowing Far Southeast Gold Resources Inc. (FSGRI) to fence off an already private property of the firm meant for drilling in Tabio, Madaymen, Mankayan.

They could not be defying the law, Godino said, citing the September 17 scuffle between 100 protesters against sheriffs and policemen implementing the court order.

Even citing Commission on Human Rights Cordillera reports, Godino criticized protestors for continuing to defy lawful orders, the latest of which was issued by Regional Trial Court branch 64 Presiding Judge Agapito Laoagan to allow LCMC to fence the area for its exploration activities.

Earlier on April 23, this year too, the National Commission on Indigenous People - Cordillera Administrative Region has sided with the LCMC and reversed its earlier temporary restraining order and denied the protesters’ request for the issuance of a writ of preliminary injunction. In that order, the protesters were directed to freely allow FSGRI to resume its drilling operations in Madaymen, upon the posting of a P500,000 bond. “We posted the bond requirement,” Godino said.

Again on on July 24, 2012 the NCIP Sheriff attempted to implement the Orders in NCIP Case 03-CAR-12 dated April 4 and 23, 2012.

"To ensure peaceful implementation of this Order, we sought assistance from elements of the Philippine National Police and also invited members of the Commission on Human Rights to observe that no violations of human rights were committed, either by the company or by members of the PNP," Godino noted.

But picketers openly refused and resisted the direct order of the sheriff, prompting Lepanto to voluntarily suspend the implementation of the order when the protesters reportedly started to become unruly.

Citing lawyer Harold D. Kub-aron, regional director of the Commission on Human Rights – Cordillera, Godino said the protesters openly defied every lawful order.

"There must be a stop into these," said Godino, foisting charges versus protesters.

The Far Southeast Gold Project, a joint venture between LCMC and the South Africa-based Gold Fields Inc., started the drilling in the disputed area in Madaymen late December 2011.

But land claimants (two of the eight families laying claim to the land) with the help of some residents stopped the operations. The protesters eventually built a shack in the area to secure the site and ignored every court order.

The drilling is for exploratory purposes prior to FSGRI's plan to mine an ore body more than a kilometer deep and some areas in Mankayan already agreed for similar activities.

source: http://www.philstar.com

Thursday, October 4, 2012

Lepanto Consolidated Mining Company LC

Lepanto Consolidated Mining Company (LC) was incorporated in 1936 and operated an enargite copper mine until 1997, after which, LC shifted to gold bullion production through its Victoria Project. LC sells its gold and silver bullion production to Heraeus Ltd. (Hong Kong) while its copper concentrate production are sold through Trafigura Beheer B.V. Amsterdam and Shanghang County Jinshen Trading Co., which are metals traders based in New Jersey, USA, and Fujian, China, respectively.

LC and its subsidiaries are involved in other businesses such as hauling, diamond drilling services, insurance, and manufacture of diamond tools. LC has two Mineral Production and Sharing Agreements for areas located in Mankayan, Benguet. The Company's subsidiaries are Shipside, Inc.; Diamond Drilling Corporation of the Philippines; Lepanto Investment and Development Corporation; Diamant Boart Philippines, Inc.; and Far Southeast Gold Resources, Inc.

Source: SEC Form 17-A (2011 and www.pse.com.ph

LC and its subsidiaries are involved in other businesses such as hauling, diamond drilling services, insurance, and manufacture of diamond tools. LC has two Mineral Production and Sharing Agreements for areas located in Mankayan, Benguet. The Company's subsidiaries are Shipside, Inc.; Diamond Drilling Corporation of the Philippines; Lepanto Investment and Development Corporation; Diamant Boart Philippines, Inc.; and Far Southeast Gold Resources, Inc.

Source: SEC Form 17-A (2011 and www.pse.com.ph

Ever-Gotesco Resources and Holdings, Inc. EVER

Ever-Gotesco Resources and Holdings, Inc. (EVER) was incorporated on September 27, 1994 as a holding company and started its commercial operations on December 1, 1995.

EVER is engaged in building shopping malls and leasing them out to commercial tenants. The malls are primarily leased out to Ever Department Store and Supermarket, cinemas, banks, amusement centers, food shops, specialty stores, boutiques, drug stores, service shops, gym and sporting facilities.

The Company operates two malls, namely, the Ever Gotesco Commonwealth Center and the Ever Gotesco Manila Plaza. The Company's subsidiary, Gotesco Tyan Ming Development, Inc. (GTMDI), is engaged in the real estate business, and owns and operates the Ever Gotesco Ortigas Complex.

In 2009, EVER and GTMDI entered into a compromise agreement with creditor banks of its foreclosed properties pending court cases.

Source: SEC Form 17-A (2011 and www.pse.com.ph

MRC Allied, Inc. MRC

MRC Allied, Inc. (MRC) is a property development firm in the Philippines which has found its niche in the development of master planned, integrated residential, commercial, recreational, tourism and industrial areas within a single community or township.

Originally incorporated on November 20, 1990 as Makilala Rubber Corporation, the Company's activities were originally involved in the processing and export of baled natural rubber. In 1993, new stockholders acquired the Company from Philtread Tire & Rubber Corporation and diversified the Company into real property development, particularly into township development. On October 25, 1994, the Securities and Exchange Commission approved the change in the Company's corporate name to MRC Allied Industries, Inc. In 1997, MRC decided to divest its rubber business to Makrubber Corporation, a wholly-owned subsidiary, to focus on its core business of real property development. However, in 2000, Makrubber stopped its commercial operation due to the worsening of the raw material supply and the problem of peace and order in the Mindanao area.

On September 23, 2008, Pacific Asia Capital Corporation (PACC), now Menlo Capital Corporation, and MRC entered into a Deed of Assignment, wherein PACC shall assume the liabilities of MRC from various creditors. PACC and MRC agreed to extinguish the debt by converting it into common shares out of MRC's increased authorized capital stock of P3.0 billion and PACC shall subscribe to P725 million covering the 25% minimum subscription for the partial increase of MRC's authorized capital stock of P2.9 billion or 3.625 billion shares out of the 14.5 billion shares increase with par value of P0.20 per share. PACC shall assign, convey, transfer and consider as extinguished MRC's debt in the amount of P328.50 million as partial payment for 1.642 billion shares. As a result of this agreement, PACC shall have 3.625 billion shares, or 87.88% of the outstanding capital stock of MRC, thus effectively acquiring control over MRC.

At present, the principal asset of the Company consists of two land banks. The first is a 160 hectare industrial estate in Naga City, Cebu and the second consists of 700 hectare of raw land in San Isidro Municipality, Leyte. Located thirty five (35) kilometers away from the Mactan International Airport, the industrial estate in Naga City, known as the New Cebu Township One, is registered with the Philippine Economic Zone Authority as a special economic zone.

Source: SEC Form 17-A (2011 and www.pse.com.ph

Originally incorporated on November 20, 1990 as Makilala Rubber Corporation, the Company's activities were originally involved in the processing and export of baled natural rubber. In 1993, new stockholders acquired the Company from Philtread Tire & Rubber Corporation and diversified the Company into real property development, particularly into township development. On October 25, 1994, the Securities and Exchange Commission approved the change in the Company's corporate name to MRC Allied Industries, Inc. In 1997, MRC decided to divest its rubber business to Makrubber Corporation, a wholly-owned subsidiary, to focus on its core business of real property development. However, in 2000, Makrubber stopped its commercial operation due to the worsening of the raw material supply and the problem of peace and order in the Mindanao area.

On September 23, 2008, Pacific Asia Capital Corporation (PACC), now Menlo Capital Corporation, and MRC entered into a Deed of Assignment, wherein PACC shall assume the liabilities of MRC from various creditors. PACC and MRC agreed to extinguish the debt by converting it into common shares out of MRC's increased authorized capital stock of P3.0 billion and PACC shall subscribe to P725 million covering the 25% minimum subscription for the partial increase of MRC's authorized capital stock of P2.9 billion or 3.625 billion shares out of the 14.5 billion shares increase with par value of P0.20 per share. PACC shall assign, convey, transfer and consider as extinguished MRC's debt in the amount of P328.50 million as partial payment for 1.642 billion shares. As a result of this agreement, PACC shall have 3.625 billion shares, or 87.88% of the outstanding capital stock of MRC, thus effectively acquiring control over MRC.

At present, the principal asset of the Company consists of two land banks. The first is a 160 hectare industrial estate in Naga City, Cebu and the second consists of 700 hectare of raw land in San Isidro Municipality, Leyte. Located thirty five (35) kilometers away from the Mactan International Airport, the industrial estate in Naga City, known as the New Cebu Township One, is registered with the Philippine Economic Zone Authority as a special economic zone.

Source: SEC Form 17-A (2011 and www.pse.com.ph

Boulevard Holdings, Inc. BHI

Boulevard Holdings, Inc. (BHI) was established and incorporated on July 13, 1994 as a holding company with primary interests in the following businesses: ownership of companies involved in the development of hotels and resorts & tourism-related businesses and investments in strategic land locations & rentable real estate properties.

BHI subsidiaries cater to premiere and elite clients, with an ambition to expand its Friday's Hotel brand to at least nine different idyllic locations throughout Asia in the following 10 years. The Company has also determined to create long-term value by increasing its capitalization, entering into joint ventures for tourist destination development and commanding a significant share in the primary resort home market outside Metro Manila.

BHI has one business segment concentration which is hospitality and leisure with Friday's Holdings Inc., owner and operator of Friday's Boracay Island Beach Resort in Boracay Island, Aklan, Crown One Land, Inc., and Friday's Puerto Galera, Inc.

Source: SEC Form 17-A (2011 and www.pse.com.ph

Subscribe to:

Comments (Atom)